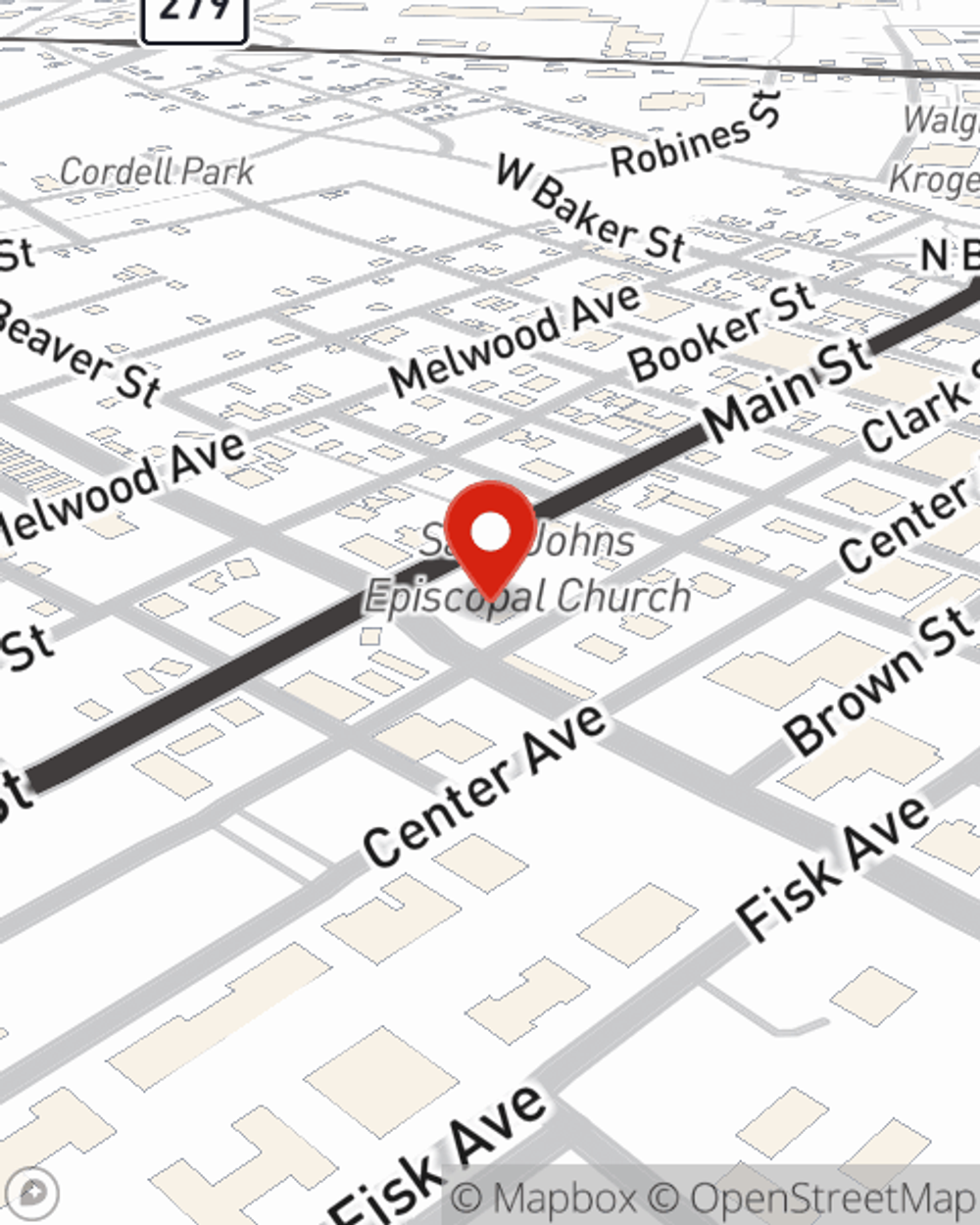

Business Insurance in and around Brownwood

Calling all small business owners of Brownwood!

Helping insure businesses can be the neighborly thing to do

- Brown County

- Texas

- Mills County

- San Saba

- Coleman

- Comanche

- Rising Star

- Brownwood

- Cross Plains

This Coverage Is Worth It.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Mike Hall help you learn about quality business insurance.

Calling all small business owners of Brownwood!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your wages, but also helps with regular payroll costs. You can also include liability, which is vital coverage protecting you in the event of a claim or judgment against you by a visitor.

At State Farm agent Mike Hall's office, it's our business to help insure yours. Get in touch with our terrific team to get started today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Mike Hall

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.